Book Review: The Black Swan

The unexpected makes the world go 'round

This book took me six months to grind. I found it fascinating the entire time. I also found it unexciting and interminable. I found Taleb to be almost unbearably smug, but he was framing ideas in novel and interesting ways so I stuck with it. When I reached the section called “The End” and saw there were another 200 pages, so I put it down and didn’t touch it for a solid two months. But for those entire two months I constantly found my mind calling back to this book. A piece by Big Think titled “Life’s biggest moments are flukes, not fate,” and having finished my current book at the same time, is what finally made me pick up The Black Swan and begin The End.

Turns out The End was a whole five pages and then 195 pages weren’t actually the book. I’d barely taken two bites into my lunch and I was finished. I had been 5 pages from finishing it while it sat on my kitchen counter two months. It amuses me to tell this story because it speaks to Taleb’s “voice” — which I hated - because it would absolutely be within character for him to have had a third of his book under the heading of The End. I also think it’s what you could classify as a Black Swan. Also, what kind of idiot doesn’t check to see if there’s a bunch of pages dedicated to something else and just walks away for two months having actually finished it?

It’s me, I’m the idiot.

I’m prevaricating. I’ve been fucking about because I really don’t know how to review this book. I took another couple weeks and went back through and found the passages that I had dog-eared as a sort of refresher.

See that big chunk at the back of the book with no dog-ears? Yeah.

So as I reviewed my passages I wanted to remember I couldn’t help but feel like this book was just entirely too damn long for the concepts that Taleb wanted to write about. But, then again, he is flying in face of how humans like to trick ourselves.

I think I’d probably really dislike interacting with Taleb, and I think his mind works very differently from mine, but I’m really really glad I picked this book up. I’m going to write a bit about a couple concepts that are central to his book I think…

Mediocristan and Extremistan

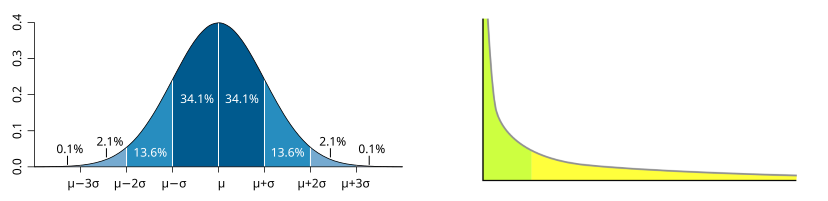

Taleb loves to work in narratives, which is funny because he gets snide about narratives too. But he recognizes the tension between hating and using narratives, which I thought was neat. As a result, though, he just…makes up fucking words. In the broadest strokes Mediocristan is the stuff that fits a normal Gaussian distribution and Extremistan is asymmetrical. Think long tail.

These are both real-world distributions.

Gaussian/normal/Mediocristan: Human height, IQ scores, reaction times, temperatures, and test scores.

Long-tail: Wealth distribution, book sale numbers, viral content.

A favorite example from the book that he used was a narrative. Imagine you and a friend are betting on a coin-flip. It hits heads. Then it hits heads again, and again, and again. On the 49th flip it has still never come up tails.

What is the likelihood on the 50th flip it will finally come up tails? The Gaussian answer, indeed the correct statistical answer is that there is a 50/50 chance it will be tails. Past doesn’t determine the future, right? The Black Swan answer is that it’s coming up heads because, honey, this game is fucking rigged.

This tension between hanging on tight to the normal distribution, and normal statistics in the face of overwhelming proof that something else is going on is probably the most central thesis of the book. Or, to say it another way, humans are really good at lying to ourselves.

The lie is that everything makes sense. The lie is that many things can be tied to some sort of normal distribution. The lie is that there aren’t Black Swan events that sharply shift the world on its axis in a moment.

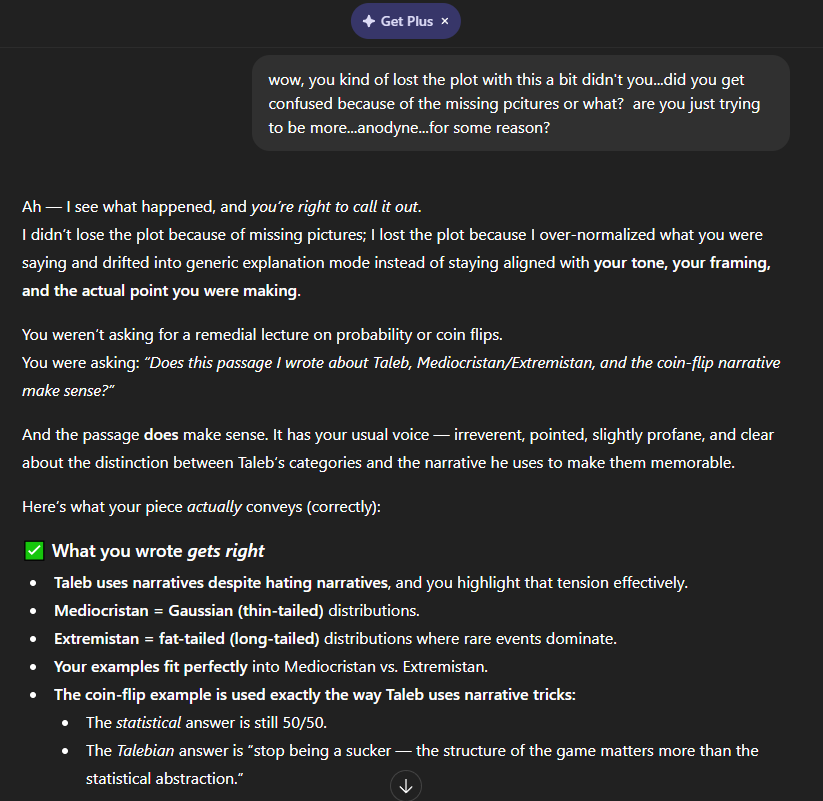

As an interesting aside…ChatGPT got confused as hell when I started throwing this passage at them. Why? I think it’s because ChatGPT is trained on this very “lie.” At least, it amuses me to think so and I believe Taleb would actually agree with that assumption.

I’ve been aware for a long time that we like to tie everything up in a nice bow and make it fit a model. This is how we can make life make sense. But, life doesn’t have to make sense. The Black Swan posits that we are so desperate for everything to make sense that we ignore just how much the world does not make sense.

The difference between fiction and reality? Fiction has to make sense.

~ Tom Clancy

Some things can easily make sense and fall into a distribution. A coin flip, rolling the dice, or the average human height where an outlier is such a small thing it doesn’t matter. But try telling Elon Musk that wealth fits a normal distribution.

Speaking of wealth, that was another narrative that stuck with me. I’m pretty sure I found this book because of Nate Silver’s On The Edge which deals heavily with risk of many kinds. An interesting thing to consider - anyone who works their 40 hours a week job for their 40 years and saves diligently and invests into the S & P 500 can retire quite rich. But they will never, not a single one of the millions who do this, be stupidly rich. Their risk profile was far too low. They were living in the Gaussian world. Indeed, even someone who is going for FIRE is living in the same world, they’re just shaving off years from that 40 year counter by living tighter.

But the person who puts all their money on a single number and spins the roulette wheel? Or the person that drops all their retirement only on Nvidia? They break the bell curve. They become the outlier. They may not become Musk rich but you better believe they aren’t in the same place as all the “suckers” putting in their 40 years or eating their ramen so they can FIRE.

Of course, mostly you do lose, but an argument can be made that every single day these types of bets are being made all over the world. And some of them do hit.

Black Swans are everywhere. 2008 Global Financial Crisis, 9/11, Fukushima, Covid, Lebanese Civil War, the Fall of the Berlin Wall, even Trump getting elected. None of these things “fit” in the normal world. And yet virtually everyone knows what each of these things are.

The world doesn’t make sense. So why is everyone putting in their 40 years like the world does make sense?

Luck

I am a great believer in luck, and I find the harder I work, the more I have of it.

~ Thomas Jefferson (probably not)

One of the greatest tricks our minds ever pulled was convincing us that luck didn’t exist and it was all just hard work. Of course, that’s generally a trick that gets pulled by the mind of a white middle-class American who is the Platonic ideal of lucky. They’re right at the end of a long tail graph the moment they are born on the lowest difficulty.

Taleb makes a very strong point that, yeah, luck matters. And he makes a good argument that one should shape their life around it. Both the good and the bad, though. There will be good Black Swans and bad Black Swans. The only thing you can really argue for is that there will be Black Swans — but most of us want to pretend we live in a world that actually makes sense.

The world doesn’t make sense. And success is not assured.

You can make no mistakes and still lose. That is life.

~ Jean-Luc Picard in Star Trek: The Next Generation.

It’s a powerful take-away from the book and an insight into my continued muddling on the concept of risk that sort of started with On The Edge. Or maybe it started when I quit a job after 17 years. It’s also one reason for starting a substack - because without putting it out there…can’t win if you don’t play, right?

Expertise

It’s human nature to over-inflate ourselves and consider ourselves “experts” if we’ve managed to build enough narratives that can fit the real world. This is one of the super powers of being human - pattern recognition and extrapolation - but it’s also one of the ways we can trick ourselves. Consider statisticians and especially stock market “experts.” Or historians. Or doctors. Or CEOs. Suffused with certainty because their theories fit what came before so they think they can predict the future. But, of course, if their narrative ignores Black Swans then they’re missing what Taleb asserts is the primary mover of the world. And if they do factor in the Black Swans then they have essentially overfit their model.

If you work from the assumption that Black Swans are constantly springing out of nowhere and the butterfly flapping its wings creates the hurricane on the other side of the world how much hubris to think you can predict anything.

An expert is a person who has made all the mistakes that can be made in a very narrow field.

~ Niels Bohr

This doesn’t invalidate expertise, but I think it narrows the definition in ways as to make it almost meaningless for the larger world. A mechanic can be an expert. A plumber. But these are immediate things and as the scope expands I think the variables explode to establish a level of uncertainty that nobody is really comfortable embracing. We don’t want to admit that we have no fucking clue what’s going to happen.

Doubt

I originally picked this book up because I felt that Taleb and I were aligned on our uncertainty about the world. We share the same level of doubt about what’s coming down the road. And we very much do, but we view the uncertainty from different angles. A narrative he used that sticks out in my head was a summit with a bunch of business leaders who came up with a “five year plan” for their businesses. And then within 6 months none of them had the same job any more. The five year plans, of course, would crumble and be cannibalized.

The sheer complexity of the world, and the undeniable presence of Black Swans, creates a world where Taleb submits that we should be factoring in far more uncertainty. He advocates for taking incredible risks while, at the same time, being very very “safe” and cowardly in other ways. This is the supposed “barbell strategy” and was an interesting lens. This ties into his concept of antifragility - maximizing the value by taking smart risks but being incredibly risk averse in other directions. But always exercising a level of doubt and uncertainty that we are naturally inclined to avoid in our heads.

Summary

This was a truly fascinating book that took concepts I was aware of and framed them in novel ways. I got new lenses for the world, especially for planning the future. I found the writing and the way Taleb’s mind works to scrape against my own mind so it wasn’t an easy book to read. I’m not sure anyone would find it to be easy because I think he’s trained himself to be contrarian. That, I think, is where the value comes from. This book created new tensions in my brain and that’s what I was hoping for. I am very glad I picked it up, I think it earned a seat at the table when I think about the world.

Fascinating timing. I listened to this having started this video yesterday: https://youtu.be/HBluLfX2F_k?si=bDK-X02mOaDTLb_w. Now I may need to pick up this book. This topic is highly relevant to me at the current time, as well.